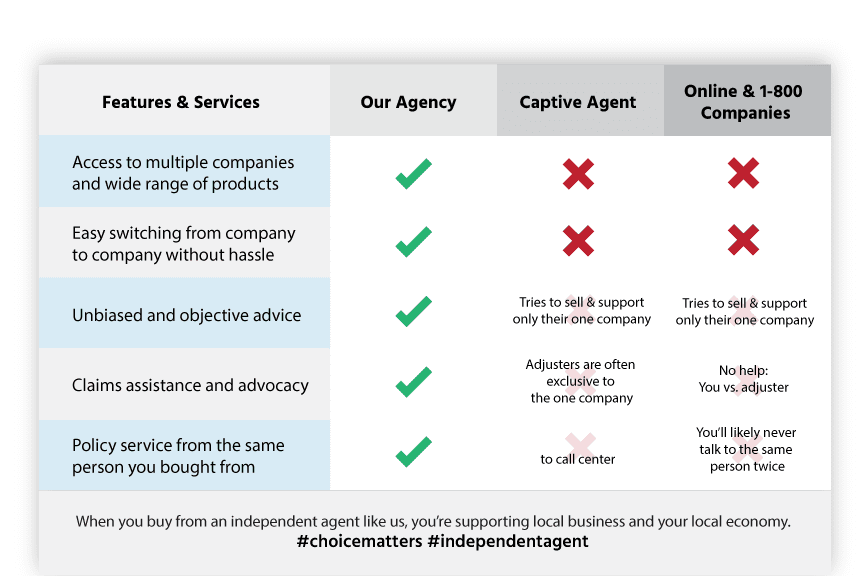

So what’s the difference between a captive agent and an independent insurance agent?

Captive Agent

An insurance agent who only works for one insurance company. A captive agent is paid by that one company either with a combination of salary and commissions or with just commissions. He or she may be a full-time employee or an independent contractor, and may be provided with office space and benefits by the employer. Captive agents typically have in-depth knowledge of their particular company’s insurance products, but cannot help a client who does not need or does not qualify for that company’s products. The parent company may push its captive agents to sell certain policies or meet certain sales quotas which sometimes causes agents to sell the product that best meets their needs (quota) instead of the client’s needs. If an existing clients rates go up, the captive agent has real solutions for the client other than reducing coverages in order to reduce the rate.

Independent Agent

An insurance agent representing several insurance companies. The agent is independent from all the companies he or she sells for, and can therefore in theory evaluate different insurance policies objectively. Independent agents pay all their own expenses and keep their own records and earn their income from commissions on the policies they sell. Having multiple companies to choose from truly allows the agent to look out for the best interest of the customer. If an existing client’s rates go up, the independent agent is at will to “re-shop” the clients needs in order to present the client several options again. An independent agent allows the consumer an opportunity to maintain the relationship with an agent they know and trust even if their particular insurance company takes actions that adversely affect the customer. The agent simply places the customer’s policies with another company.